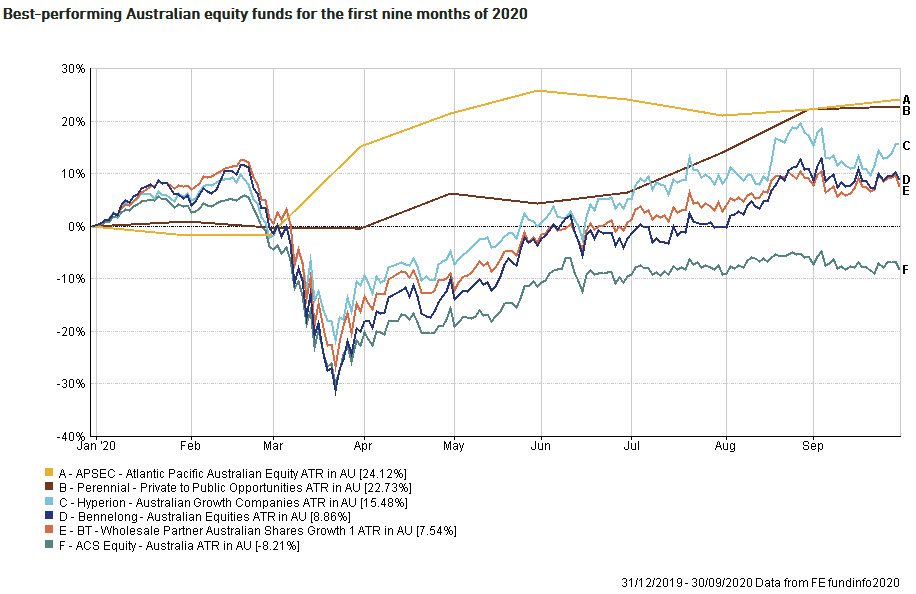

Money Management in October reviewed the performance of the Australian equity sector, which has continued to deliver negative returns throughout 2020, due to the ongoing economic fallout from the global pandemic. According to FE Analytics, within the Australian Core Strategies universe, the Australian equities sector had lost -8.21% since the start of the year to 30 September 2020.

The best performing fund in the sector was the Atlantic Pacific Australian Equity Fund (APAEF), returning 24.1% during this period, continuing the strong outperformance first identified by Money Management in its May feature and then again in July.

How prepared is your portfolio for the next major correction?

As Money Management explains, a key to the Fund’s successful performance in 2020 was prudent decision making to reduce market risk, through effective market hedging, protecting investors from the COVID-19 led market decline, and throughout this year’s volatility.

The APAEF, which celebrated it’s 7-year Anniversary milestone in June, is a long-bias equity market product which typically buys or short sells Australian listed securities and derivatives, with a core focus on downside protection.

Risk management is an essential part of our DNA. We are not prepared to accept large drawdowns in the funds entrusted to us by our investors, which is the reality faced by all long-only fund managers when markets move against them.

Rather than just chasing upside returns and selling down to cash as our defensive position (long), we pursue active hedging strategies to protect capital and also capture returns when the market goes down (short). This is achieved through a combination of long stocks, short stocks and short share price index (SPI) futures to hedge out risk.

FE fundinfo 5 Crown Rating

The long-term effectiveness of these strategies was acknowledged in August 2020 by FE fundinfo, parent company of Money Management, who awarded the Fund a coveted 5 Crown Fund Rating. This places the APAEF in the top 10% of its assessed benchmark of more than 500 comparable Australian managed funds.

Annualised returns since inception in June 2013 of the Fund are 9.4% p.a.** vs the S&P/ASX200 Accumulation Index returning 6.6% p.a. as at September 30, 2020.

Moreover, FE fundinfo assess the APAEF as delivering these returns with lower volatility than the ASX200*, due to the focus on risk management.

In the face of the prevailing economic headwinds of 2020, many investors face the choice of keeping their savings in cash, with near zero returns, or risking exposure to the current extreme volatility of the share market.

Fortunately for risk-averse investors who still want appreciable capital gains, the APAEF may offer an attractive solution.

Get in touch today and we’ll send you all the information you need to help decide how the APAEF’s long/short investment approach could help diversify and add protection to your investment portfolio.

[hubspot type=form portal=6426786 id=850f8b42-0199-480d-8d96-069795525e55]