When George Paxton and I started the Atlantic Pacific Australian Equity Fund (APAEF) 10 years ago, in June 2013, we had a core aim to do things differently and create a Fund that would not only provide positive returns, but would also protect investor capital when share prices drop.

Running a large hedge fund in Asia during the GFC gave me profound insights into the pain investors felt as they lost large shares of their savings while markets globally dropped as much as 50% from their 2007 peaks.

This was a key driver of our essential risk management mantra. We are not prepared to accept large drawdowns in the funds entrusted to us by our investors, which is the reality faced by all long-only fund managers when markets move against them.

The mathematics of loss means that a -25% drawdown needs a 33% gain, and a -50% drawdown requires a 100% gain, just to break even.

The APAEF was created as a long/short fund that can capture upside volatility while minimising downside volatility, a philosophy we believe will allow us to continue to outperform over the long term.

Rather than just chasing upside returns and selling down to cash as our defensive position (long), we pursue active hedging strategies to protect capital and also capture returns when the market goes down (short).

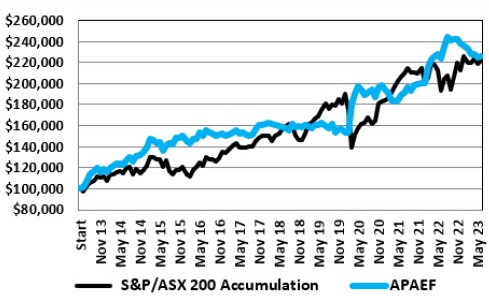

This risk management and proactive trading mantra has allowed the Fund to significantly outperform the market since inception, and also smooth out volatility during market downturns, as you can see below.

Cumulative Returns of $100,000 since June 2013

Past performance is not a reliable indicator of future performance. Source: APSEC Funds Management, May 31, 2023. Annualised returns since inception in June 2013 of the Fund are 8.5% p.a. vs the S&P/ASX 200 Accumulation Index returning 8.2% p.a. as at May 31, 2023. If an investor invested $100,000 into the APAEF in June 2013 and reinvested all distributions, their initial investment would now be worth $224,500, after all fees have been deducted. Individual tax has not been taken into account. *

Moreover, the largest drawdown the Fund has experienced in 10 years since inception is still only -7.7%, while the largest drawdown for the S&P/ASX 200 in the same time period was -26.7%.^

This is especially important for many investors and retirees, helping address the dilemma of moving into cash and getting almost zero real returns or moving into shares and facing the ongoing risk of significant capital loss in the event of another market correction or crash.

Our investment philosophy

We’re style-neutral and we look for opportunities across all market cycles, adjusting our tactics and portfolio positioning accordingly. We call this our Quadruple Alpha Process.

We overlay a number of frameworks to assist in positioning the Fund’s portfolio of investments. That’s a combination of fundamental stock analysis, event analysis, an understanding of macroeconomic issues, and quantitative analysis.

Hedging portfolio risk

Market downturns, and even major events like the GFC, or the recent COVID-19 led crash happen regularly, and although you can’t predict their exact timing, if you have the right tools and risk management in place, they can help you ride out the worst of the shocks.

Our fully hedged portfolio was key to the Fund’s success through the March maelstrom that drove the S&P/ASX 200 Index down 21.2 per cent – that was long stocks, short stocks and short share price index (SPI) futures – and the decision to hedge out risk over the weekends.

As prices rebound, we’re continuing to be hyper-vigilant in monitoring our trading positions, using HALO as the competitive edge in identifying opportunities to buy quality stocks that exhibit the pricing signals of being oversold, or where similar companies are lagging the performance of their group.

Stay tuned in coming weeks as we can continue to share more insights into successful hedging and trading strategies, or contact our team at any time if you’d like to discuss how you can protect and grow your investments through these turbulent times.