In the next market correction, how will you protect your investments?

Ongoing concerns in recent months about rising inflation have now been compounded by a slew of emerging economic disruptions, including financial shocks to multiple sectors in China, energy shortages, global supply chain disruptions and the resurgence of the pandemic, among many others.

In a recent CNBC poll of more than 400 chief investment officers, equity strategists and portfolio managers, most responded that now is a time to be very conservative in the stock market, regarding the market risk they are willing to accept for themselves and their clients.

Source: CNBC Delivering Alpha investor survey – September 2021

For most private and professional investors, though, the only way to proactively manage risk and minimise losses if these mounting headwinds lead to a market downturn will be to try and time the correction and sell down to cash, or other low-return safe harbour investments.

Fortunately, the Atlantic Pacific Australian Equity Fund (APAEF) has offered investors an alternative path for more than 8 years.

We use active hedging and trading strategies which minimise downside risk, while still providing strong performance, as evidenced in the last major market correction in March 2020, when the Fund made 17.2% while the market crashed by -21.2 per cent.

How prepared is your portfolio for the next major correction?

This article covers:

- Inflation and rates

- China’s growing economic woes:

- Property sector downturn

- Tech sector plunge

- Northern hemisphere energy crisis

- The resurgent pandemic

- The APAEF’s long-term history of protecting investor capital during periods of economic downturn.

Key Economic Headwinds

Inflation and interest rates

The trillions of dollars of ongoing stimulus support propping up economies throughout the pandemic have pushed equity markets to speculative all-time highs, with valuations often disconnected from their underlying fundamentals.

Concerns that higher than expected inflation growth could cause sudden share market sell downs crystallised in July when the US Federal Reserve released substantially upgraded inflation forecasts. Key projections for core inflation rose from 2.2 per cent up to 3 per cent, with interest rate hikes also expected sooner than previously forecast.^

To learn more about this valuation disconnect and possible portfolio impacts, view our recent educational webinar, where APSEC Fund Manager Nicolas Bryon discussed risk management strategies to counter this growing risk of inflation.

China’s growing economic woes

Geopolitical tensions, pandemic induced lockdowns and the Chinese Government’s stated goal of wealth redistribution for common prosperity have resulted in a number of high profile financial shocks to Australia’s largest trading partner, notably:

– Property sector: Evergrande, the second-largest developer in China, is on the brink of bankruptcy with more than $US300bn in debt and was placed into a trading halt after missing 2 scheduled international bond repayments.

Evergrande’s demise is emblematic of the issues facing many Chinese developers, following last year’s introduction of the Three Red Lines policy for property developers, designed to reduce debt within the industry, curb runaway property prices and raise construction standards.

There are fears that this could lead to systemic disruption of China’s vast real estate market, further dampening demand for Australian resources exports in the process, with potential ripples across the global financial sector.

– Tech sector: Before Evergrande, the tech sector was the prominent target of government reform, severely impacting many Chinese companies with international exposures, including Tencent, Didi and notably Jack Ma’s companies Alibaba and ANT Group.

By August 2021, Nasdaq reporting showed that the Nasdaq Golden Dragon China Index, which tracks the performance of 98 US-listed Chinese companies, had dropped in valuation by $US920 billion in the calendar year.

At publication date, these stock values remain deeply depressed, as seen by the Invesco Golden Dragon China ETF (PGJ:NAS), which mirrors the index and shows a correspondent underlying decrease.

Source: HALO Technologies – October 19, 2021

Northern hemisphere energy crisis

A shortage of gas and coal is leading to power disruptions across Europe and China in the run up to northern winter.

Europe’s gas stockpiles are at their lowest seasonal level in more than a decade, while gas futures markets in many countries surged to all-time highs in October, fuelling fears of higher prices creating further inflationary pressures.

Source: Intercontinental Exchange, Inc. (ICE) – October 18, 2021

In China, residential and commercial electricity customers have faced weeks of extensive rolling power cuts, as utilities try to manage significant power shortages, adding further supply-side pressure to already stretched global supply chains.

The resurgent pandemic

And of course, closer to home, the dreaded Delta variant this year forced more than half of Australia into months of strict ongoing lockdowns, which are just ending, at the cost of billions of dollars of direct stimulus support and lost economic output.

If these mounting headwinds lead to a sudden or sustained market downturn, how prepared is your portfolio for the next major correction?

The Atlantic Pacific Australian Equity Fund

Risk Management is in our DNA

Share investing is an essential generator of long-term prosperity, and most Australians are exposed to the market, either directly, through managed investments, or via their superannuation.

History has shown that markets will continue to go up in the long run, but there are always periods of downturns, which can happen quickly and have a substantial impact for investors who need ready access to their funds, especially in or nearing retirement.

Corrections can happen suddenly, with a fast recovery, as seen in the 2020 Pandemic crash, or can happen over years as was the case during the Global Financial Crisis. Prudent planning can help investors minimise the potential impacts of these downturns.

The APAEF is a long/short managed fund which typically buys or short sells Australian listed securities and ASX 200 futures contracts, with a core focus of providing downside risk protection, while still capturing upside volatility.

We are not prepared to accept large drawdowns in the funds entrusted to us by our investors.

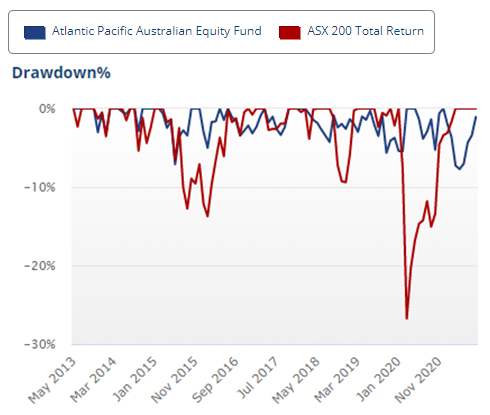

As you can see in the chart below, the largest drawdown the fund has experienced in 8 years since inception is only -7.7%, while the largest drawdown for the S&P/ASX 200 in the same time period was -26.7%.^^

Visual representation of the APAEF’s downside capture vs the S&P/ASX 200 since inception in June 2013. Source Australian Fund Monitors Product Assessment – Atlantic Pacific Australian Equity Fund, October 2021^^^

Visual representation of the APAEF’s downside capture vs the S&P/ASX 200 since inception in June 2013. Source Australian Fund Monitors Product Assessment – Atlantic Pacific Australian Equity Fund, October 2021^^^

Pleasingly, even with this intrinsic focus on risk management, the Fund has delivered strong performance over the long-term. As at August 31, 2021, annualised returns (net of all fees) since inception in June 2013 of the Fund are 8.4% p.a.* vs the S&P/ASX200 Accumulation Index returning 9.6% p.a.

Importantly, due to our core focus on downside protection, FE fundinfo, parent company of Money Management, assess the as Fund as relatively lower risk, currently rating the APAEF at 77% of the volatility than the ASX200**.

For investors who are risk-averse and need decent returns to fund their lifestyle into retirement, the APAEF may offer an attractive solution especially in current market conditions.

Simply complete your details below and we’ll email you the latest fund information or promptly answer any questions you have:

[hubspot type=form portal=6426786 id=3a54f3e4-aa5a-4a9f-b596-39bf74e24b4b]

All information correct as at October 19, 2021.

^ https://www.federalreserve.gov/newsevents.htm

^^ APSEC Funds Management, August 31, 2021: https://www.apsec.com.au/wp-content/uploads/2021/Fund-Performance-Reports/APAEF_202108.pdf

^^^ Australian Fund Monitors Product Assessment – Atlantic Pacific Australian Equity Fund, October 2021

* Fund Returns are prepared on a redemption unit price basis after management and performance fees inclusive of GST. Distributions are assumed to be re-invested at the mid unit price. Individual tax is not taken into account in deriving Fund Returns. In calculating the NTA, the Atlantic Pacific Australian Equity Fund (“Fund”) asset values have been calculated using unaudited price and income estimates for the month being reported. Past performance is not indicative of future performance.

**Source: FE fundinfo, August 31, 2021 https://investmentcentre.moneymanagement.com.au/factsheets/mi/k1fx/apsec-atlantic-pacific-australian-equity