A perfect storm of economic headwinds

The past 6 months have been a turbulent period for share market investors, with the S&P/ASX 200 down substantially from its August 2021 highs, losing -4.2% for the 6 months ending February 28, 2022. Through this challenging period, the Atlantic Pacific Australian Equity Fund (APAEF’s) focus on proactive risk management has seen the Fund return 10.5%, an excess return of 14.2%.*

What’s driving the downturn?

By mid-2021, the trillions of dollars of ongoing stimulus support propping up economies throughout the pandemic had pushed equity markets to speculative all-time highs, with valuations often substantially disconnected from their underlying fundamentals.

As we’ve warned for some time, these unprecedented levels of stimulus are now creating heightened inflationary pressures, forcing central banks to curtail stimulus and raise interest rates sooner than planned.

This was evidenced in December when the Bank of England became the first major central bank to raise interest rates as inflation climbed to the highest level in a decade, with other central banks signalling the unwinding of stimulus and interest rate hikes sooner than planned.

As inflation in the US hit a near 40-year high in December, the U.S. Federal Reserve has signalled money tightening at a much faster pace than expected until very recently, with leading economists now forecasting at least 3 interest rate hikes in 2022 and 3 more in 2023.

Higher interest rates could cause sustained downward pressures on market pricing, as investors look to improving bond yields and other safe haven assets.

Inflationary pressures are being compounded by a slew of other economic headwinds, including the ongoing pandemic, financial shocks to multiple sectors in China, energy shortages, global supply chain disruptions and heightened geopolitical tensions in eastern Europe and the Indo-Pacific.

The net effect is likely to see an extended period of increased volatility and risk, with investors left to consider options like trying to time the dip, hold underperforming assets in the hopes of a rebound, or exit the market altogether.

Fortunately, the APAEF offers a different investment option, with a long-term proven history of providing strong diversified returns with low correlation and less volatility than the S&P/ASX 200.

What options are there to protect against ongoing volatility?

Most Australian managed funds, and individual investors, are long-only, meaning their investments profit as prices go up, but when markets go down, the only option is to sell down to cash or other low earning instruments to avoid ongoing losses.

The APAEF is substantially differentiated, as a long/short (hedge) fund which typically buys or short sells Australian listed securities and S&P/ASX200 futures contracts, offering downside protection, while still providing strong upside returns.

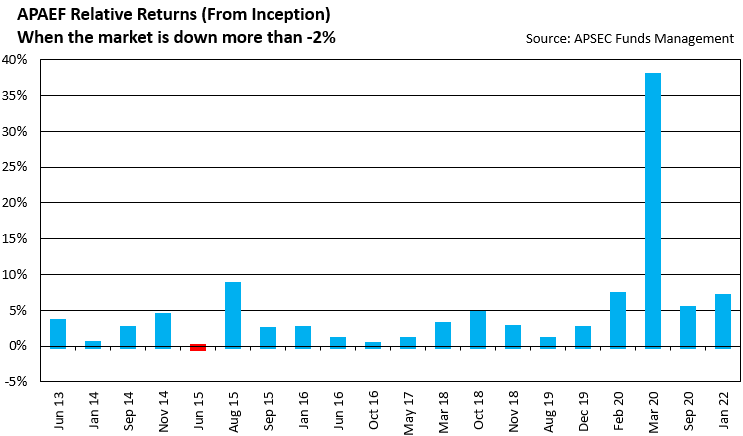

As you can see in the chart below, since inception in June 2013, the APAEF has provided positive relative returns in all but 1 period when the S&P/ASX 200 has fallen by -2% or more, showing the long-term effectiveness of these risk mitigation strategies.

This inherent risk management mantra has allowed the Fund to deliver strong investment returns nearly identical to the market since inception, while also substantially smoothing out volatility during market downturns, adding portfolio diversification, as shown in the chart below.

Source: APSEC January 31, 2022. Cumulative returns since inception in June 2013 of the Fund are 8.3% p.a. vs the S&P/ASX200 Accumulation Index returning 8.3% p.a. as at January 31, 2022.

Importantly, due to our core focus on downside protection, FE fundinfo (parent company of Money Management) independently assess the as Fund as relatively lower risk, currently rating the APAEF at 75% of the volatility than the ASX200**.

Moreover, in more than 8 years since inception the largest drawdown the fund has experienced is only -7.7%, while the largest drawdown for the S&P/ASX 200 in the same time period was –26.7%.^

If this period of heightened market volatility does become entrenched, what protection strategies do you have for your personal or client portfolios?

The APAEF’S proprietary investment methodology

The APAEF was founded in June of 2013 by Nicolas Bryon and George Paxton, who have nearly 40 years of combined investment experience, with the core goal of outperforming the market by capturing upside returns while minimising downside risk.

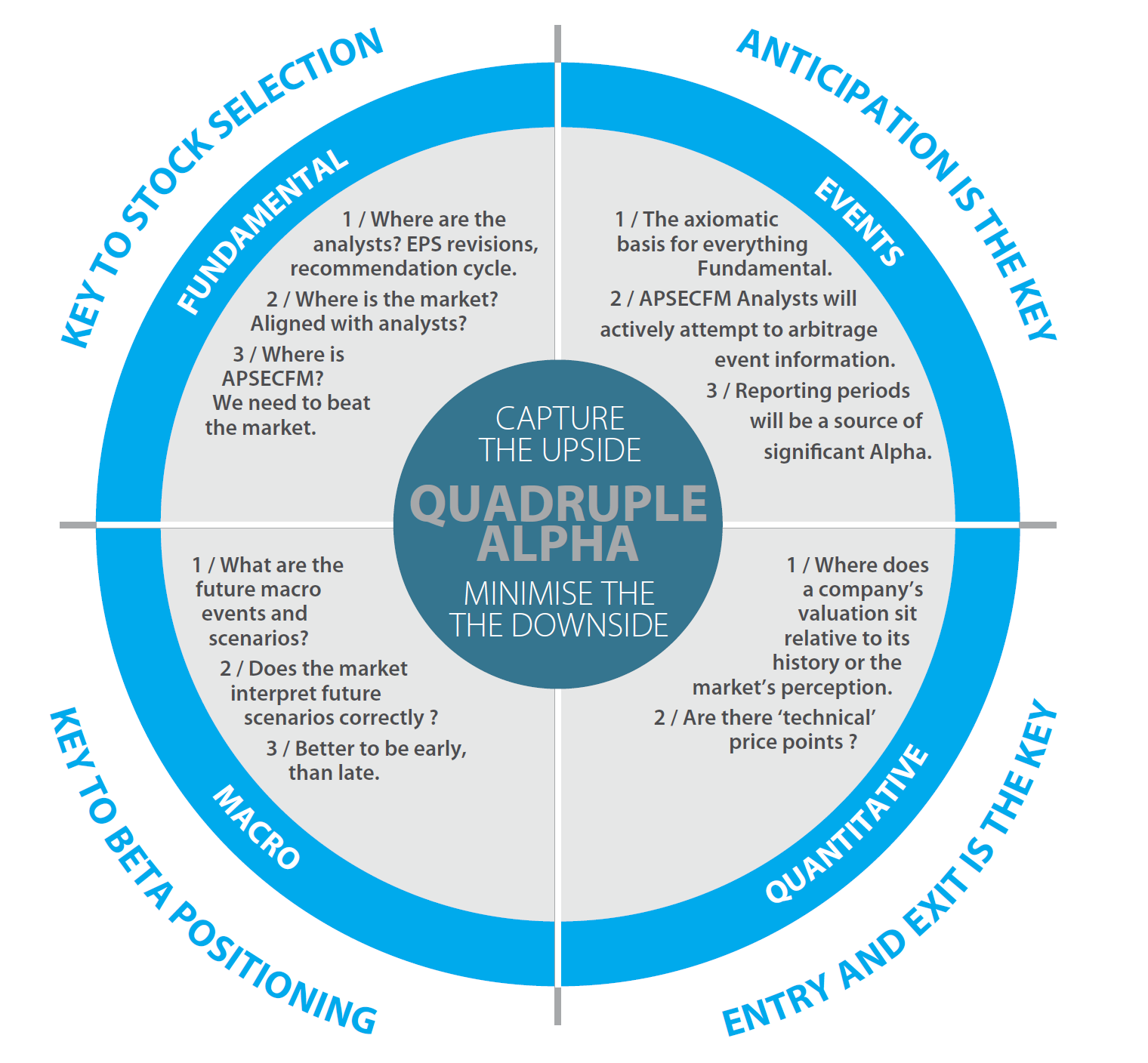

The fund uses an investment strategy known as Quadruple Alpha, a proprietary investment methodology which is consistent, definable, and is capable of producing superior risk adjusted returns throughout the cycle.

Being Style Neutral allows us to react quickly to changes in market conditions or sentiment, enabling strong performance in all market environments.

HALO – the competitive information edge

APSEC’s portfolio leads helped create the powerful share market research and trading solution HALO, which provides a competitive information edge for the fund.

The platform is now used by thousands of individuals, institutional investors and advisers for up to date research on over 30,000 global equities, advanced portfolio management tools, and signals to help guide buying and selling decisions.

The combination of highly experienced portfolio leads, cutting edge research tools, and a proprietary investment methodology which has delivered strong, stable, long-term returns means the APAEF may offer an attractive solution for risk-averse investors who still want appreciable capital gains.

Get in touch today and we’ll send you all the information you need to help decide how the APAEF’s long/short investment approach could help diversify and add protection to your own and your clients’ investment portfolio.

[hubspot type=form portal=6426786 id=3a54f3e4-aa5a-4a9f-b596-39bf74e24b4b]

All information correct as at February 16, 2022.

* Fund Returns are prepared on a redemption unit price basis after management and performance fees inclusive of GST. Distributions are assumed to be re-invested at the mid unit price. Individual tax is not taken into account in deriving Fund Returns. In calculating the NTA, the Atlantic Pacific Australian Equity Fund (“Fund”) asset values have been calculated using unaudited price and income estimates for the month being reported. Past performance is not indicative of future performance.

**Source: FE fundinfo, January 31, 2022 https://investmentcentre.moneymanagement.com.au/factsheets/mi/k1fx/apsec-atlantic-pacific-australian-equity

^ Source: https://www.apsec.com.au/wp-content/uploads/2022/Fund-Performance-Reports/APAEF_202201.pdf