We’re extremely proud to announce that the Atlantic Pacific Australian Equity Fund (APAEF) has won the award for Emerging Manager / Smaller Fund – Equity in the prestigious HFM Asian Performance Awards, held in Singapore on November 30, 2022.

The Awards are purely quantitative based and reflect the strong outperformance of the APAEF in delivering a 25.0% return for the 12 months to September 30, 2022, vs the S&P/ASX 200 Acc. returning -7.7%, and currently having only 80% of the volatility of the ASX 200 per FE Fundinfo.

Background

The HFM AsiaHedge Awards and Eurekahedge Asian Hedge Fund Awards have been separately celebrating the best and rewarding the finest in the Asian hedge fund industry since 2004. They are the most important and influential hedge fund awards in the annual calendar.

From 2021, these two leading hedge fund awards in the region joined forces to host the HFM Asian Performance Awards 2021.

After having to take place virtually in 2020 and 2021, this year’s spectacular black-tie dinner and ceremony took place on 30 November at the Shangri-La Singapore, with the best performing funds from across Asia all vying for industry-wide recognition.

APSEC FM Fund Manager Nicolas Bryon and AAIG Head of B2B Business Development Greg Schapkaitz celebrating at the HFM Asian Performance Awards ceremony in Singapore, with over 200 senior decision-makers from across the Asian hedge fund industry.

APSEC FM Fund Manager Nicolas Bryon and AAIG Head of B2B Business Development Greg Schapkaitz celebrating at the HFM Asian Performance Awards ceremony in Singapore, with over 200 senior decision-makers from across the Asian hedge fund industry.

Criteria

These influential hedge fund awards are determined objectively, using a combination of Sharpe ratios and absolute returns to ensure the awards reflect the two primary aims of hedge funds – to manage volatility, and to deliver positive returns for investors.

Leading into the judging period, the APAEF delivered a 25.0% return for the 12 months to September 30, 2022, and a 3-year Sharpe ratio of 2.5, which were the conditions that enabled us to win the award, with the Sharpe ratio signifying higher returns vs the risk taken to achieve them.

Sharpe Ratio explained

In finance, the Sharpe ratio measures the performance of an investment such as a security or portfolio compared to a risk-free asset, after adjusting for its risk.

The Sharpe ratio can help explain whether a portfolio’s excess returns are attributable to smart investment decisions or simply luck and risk.

For example, low-quality, highly speculative stocks can outperform blue chip shares for considerable periods of time, as seen in recent years of stimulus fuelled boom stocks, which have consequently been amongst the most affected by the correction. The Sharpe ratio helps provide a reality check by adjusting each manager’s performance for their portfolio’s volatility.

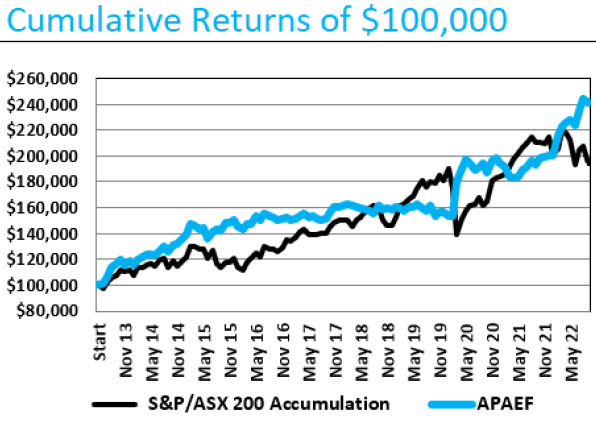

The APAEF has demonstrated that our superior returns are delivered through more than short-term speculation. Annualised returns since inception in June 2013 of the APAEF are 9.8% p.a., net of all fees, vs the S&P/ASX 200 Acc. returning 7.3% p.a. as at September 30, 2022 – an excess return of 2.5% p.a. with currently only 80% of the volatility of the ASX 200 per FE Fundinfo.

Commenting on the Award win, APSEC FM Fund Manager Nicolas Bryon noted that the award validates the APAEF’s core mandate of delivering superior long-term returns by proactively minimising downside volatility. He added his belief that “a hedge fund should never lose money over the medium to long-term – we are not prepared to accept large drawdowns in the funds entrusted to us by our investors.”

“A hedge fund should never lose money over the medium to long-term – we are not prepared to accept large drawdowns in the funds entrusted to us by our investors.” – Nicolas Bryon.

How has the APAEF achieved this?

The APAEF, which celebrated it’s 9-year Anniversary milestone in June, is a long-bias equity market product which typically buys or short sells Australian listed securities and ASX 200 futures contracts, with a core focus on downside protection.

Risk management is an essential part of our DNA. We have the mandate and tools to proactively limit downside losses, which aren’t available to most long-only fund managers when markets move against them.

Rather than just chasing upside returns and selling down to cash as our defensive position (long), we pursue active hedging strategies to protect capital and also capture returns when the market goes down (short). This is achieved through a combination of long stocks, short stocks and short share price index (SPI) futures to hedge out risk.

This risk management and proactive trading mantra has allowed the Fund to significantly outperform the market since inception, and also smooth out volatility during market downturns, as you can see below.

Source: APSEC Funds Management, September 30, 2022. Annualised returns since inception in June 2013 of the Fund are 9.8% p.a. vs the S&P/ASX 200 Accumulation Index returning 7.3% p.a. as at September 30, 2022. If an investor invested $100,000 into the APAEF in June 2013 and reinvested all distributions, their initial investment would now be worth $241,500, after all fees have been deducted. Individual tax has not been taken into account. *

How prepared is your portfolio for the next major correction?

While we’ve been pleased to see the broader market’s recent rallies, risks abound, and the effects of central banks’ fight to contain inflation, and ongoing fallout from the war in Ukraine will likely present continued challenges for equities for the foreseeable future.

Many investors are naturally wary of the potential impacts of another major market correction, with negative economic news continuing to dominate headlines.

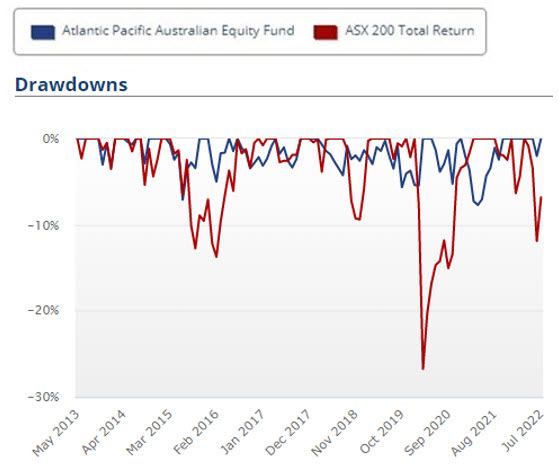

Fortunately, in most periods that the has market dropped, the APAEF has provided downside risk protection, leaving investors less exposed to drawdowns. in over 9 years since inception in June 2013, the largest drawdown the Fund has experienced was -7.7% while the largest drawdown for the S&P/ASX 200 in the same time period was -26.7%.^

Visual representation of the APAEF’s downside capture vs the S&P/ASX 200 since inception in June 2013. Source: Australian Fund Monitors Product Assessment – Atlantic Pacific Australian Equity Fund, September 2022.

Moreover, since inception in June 2013, the APAEF has provided positive relative returns in all but 1 period when the S&P/ASX 200 has fallen by -2% or more, showing the long-term effectiveness of the Fund’s risk mitigation strategies.^

Past performance is not a reliable indicator of future performance. APSEC Funds Management does not warrant that future forecasts are guaranteed to occur. ^ Source: APSEC Funds Management, September 30, 2022: https://www.apsec.com.au/wp-content/uploads/2022/Fund-Performance-Reports/APAEF_202209.pdf

Investing with ASPEC Funds Management

The APAEF accepts new applications daily, with the cutoff time of 2pm AET. Full application instructions can be found here: https://www.apsec.com.au/how-to-invest/

Or, for more information contact the team on 1300 379 307 or email enquiries@apsec.com.au.

All information correct as at November 30, 2022.

* Fund Returns are prepared on a redemption unit price basis after management and performance fees inclusive of GST. Distributions are assumed to be re-invested at the mid unit price. Individual tax is not taken into account in deriving Fund Returns. In calculating the NTA, the Atlantic Pacific Australian Equity Fund (“Fund”) asset values have been calculated using unaudited price and income estimates for the month being reported. Past performance is not a reliable indicator of future performance. APSEC Funds Management does not warrant that future forecasts are guaranteed to occur.

^ APSEC Funds Management, September 30, 2022: https://www.apsec.com.au/wp-content/uploads/2022/Fund-Performance-Reports/APAEF_202209.pdf