Data driven insights into the benefits of professional investment management

(Note, this article was originally published in February 2021 and has been updated in April 2023.)

The share market is a popular investment choice for many Australians looking to grow or protect their wealth over time.

According to the ASX Australian Investor Study 2020 (1), of 19.4 million adult Australians, 46% (9 million) held investments other than their primary residence, with another 900,000 planning to begin investing in the following 12 months.

Of these investors, more than half are direct, or DIY shareholders. The growth of available investment research and the decreasing cost of executing trades has made this an accessible and potentially lucrative pathway for investors of all experience levels.

The other major share market investment pathway, for both individuals and institutions, is the managed funds industry, which held $4,415.7 billion total funds under management in December 2022, as per the latest ABS industry data. (2)

Managed funds allow you as an individual to pool your money together with the money of multiple investors, to purchase units in the fund, and a professional Investment Manager then buys and sells shares or other assets (property, cash, bonds etc) on your behalf.

The value of units you own in a managed fund start with the amount of money you invest at the value of each individual unit at the time of purchase, along with any additional investments or redemptions you make. The unit price then fluctuates along with the underlying investments, and the value of your holdings become a function of the success of the fund’s investment performance.

All of the decisions on what, when and how much to buy or sell are made by the Investment Manager, so you should conduct careful research up front to choose a Fund with an investment strategy that suits your needs, which will be documented in their Product Disclosure Statement (PDS).

So why choose a managed fund rather than doing it yourself?

1) Expertise of the managed fund team

As with any profession, experience matters. A prime reason many investors choose managed funds rather than DIY to is have a dedicated investment professional managing their future prosperity, as they would have an accountant manage their taxes, or a lawyer managing their legal affairs.

Fund managers are strictly regulated by ASIC and other oversight bodies, especially in the wake of the 2019 Royal Commission (3) which led to increased oversight and accountability for the financial services industry, and extra protections for investors.

Reputable Funds should make it easy for investors to access details on the team that will be managing their investments, and objectively measure their short and long-term results.

The lead portfolio managers of the Atlantic Pacific Australian Equity Fund (APAEF) have decades of investment research and management experience and are backed by a highly experienced client services team dedicated to supporting investors throughout their journey with the Fund.

2) Access and use of Institutional grade research

While there are a plethora of research reports, tools, websites and other services that can provide share market information, sifting through available data and knowing how to apply what’s relevant to your investment objectives is challenging for many investors.

Fund managers usually have access to relevant research and maintain professional networks inside and outside their firms that support their investment objectives.

APSEC’s portfolio leads helped create the powerful share market research and trading solution HALO, which provides a competitive information edge for the fund.

The platform is used by thousands of individual and institutional investors for up to date research on over 30,000 global equities, advanced portfolio management tools, and signals to help guide buying and selling decisions.

Examples of HALO technical trading indicators used by the Atlantic Pacific Australian Equity Fund, October 2020.

(Click on the plus sign to see the full detail of each remaining point):

3) Diversification and risk management

Diversification is a fundamental principle of prudent investing – spreading your cash across a range of assets, asset classes, geographies etc to reduce the impact of any one investment moving against you.

Australian investors would typically select from a mix of local shares, international shares, property, bonds, and cash in a balanced portfolio.

There are also more complex products like equity derivatives (such as options or futures), Initial Product Offering (IPO’s) share buy-backs or placements, etc, that may not be offered to, or cost-effective for individual investors.

Managed funds usually have the resources to hold a larger number of stocks than individuals, and/or a range of other complementary products to help advance the Fund’s investment strategies.

Investors should take care to research the Fund’s investment mandate and asset allocation, to ensure they align with your own investment goals, whether that’s higher risks for higher returns, or more stable investments designed to preserve capital or pay a reliable income stream.

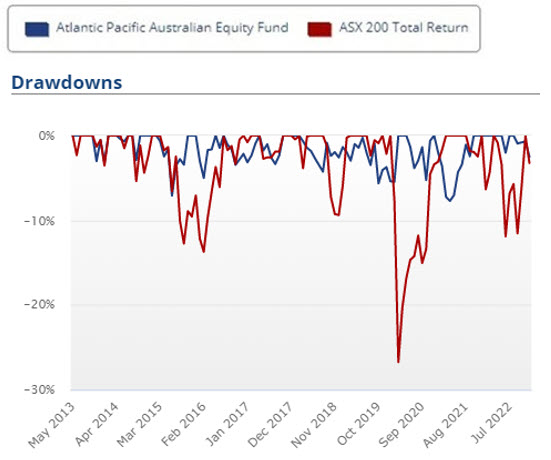

The APAEF’s long/short investment mandate allows us to invest in all of the products mentioned above, however in practice our short positions (i.e. Positions whereby we seek to profit from downward price movements) are mostly S&P/ASX 200 SPI futures contracts, designed to reduce risk and shelter the Fund from large capital drawdowns that the market can experience. This core focus on risk management has helped the APAEF smooth out the impacts of market volatility over the long run, while still generating above-market returns.

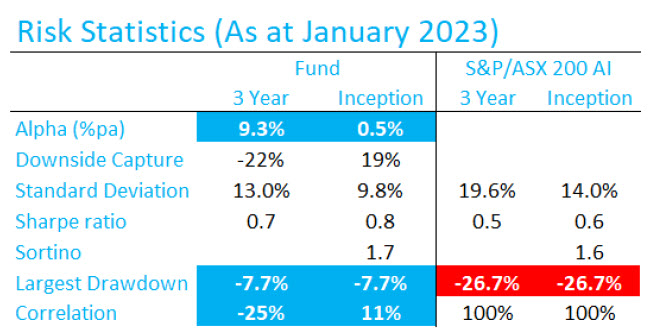

As you can see in the risk statistics chart below, the largest drawdown the fund has experienced in more than 8 years since inception was -7.7%^ while the largest drawdown for the S&P/ASX 200 in the same time period was -26.7%. You’ll also see the Correlation in the Risk Statistics table, which will allow you to measure the diversification benefit of the APAEF within a portfolio. With a correlation of -35% for the past 3 years, the Fund has been an effective counterpoint to the ongoing volatility of the S&P ASX200.

4) The ability to start small and build holdings incrementally and consistently

Managed funds allow you to start at a relatively lower threshold than some comparable investment options, like property or bonds, and then build the value of your holdings over time through ad-hoc or structured top-ups.

The APAEF, for example has a current minimum investment amount of just $20,000, and a minimum additional investment amount of $1,000, making it accessible for most investors.

In contrast, investing in property can require a minimum deposit of up to 20% of the property’s value, as well as substantial on-costs like stamp duty, inspection, conveyancing and other legal fees, creating a substantial barrier to entry for new buyers.

5) Focussed investment

Emotions and attitude play a large part in successfully navigating the share market, and can be a significant challenge for individuals in developing and sticking to a long-term investment plan.

Aside from maintaining the discipline for continually researching the market and maintaining portfolio hygiene, high levels of media noise and information saturation can lead to emotive short term behaviours, such as the well-studied syndrome of performance chasing:

– Fear of missing out on a stock that’s climbing fast can cause you to buy in at a high point of the valuation, with limited upside potential.

– Panic at a sudden drop in one of your shares can cause you to sell down at a low point, crystalising your losses with no possibility of a recovery in value.

– Excitement caused by a stock you hold that’s doing well can cause you buy more at a high point, rather than prudently taking some of the profits and rebalancing your holdings in line with your larger portfolio and investment objectives.

Fund managers are paid to professionally manage your money in line with their stated investment mandate, replacing the emotions that can lead to irrational behaviours with systematic and disciplined decisions deigned to optimise long-term returns, rather than short-term reactions.

6) Time saving and ease of reporting

Finally, a significant reason for choosing managed funds rather than DIY is the time involved in market research, portfolio management and administration tasks like tax reporting

Researching stocks to trade can be both intellectually satisfying and potentially lucrative. However, maintaining this research across a balanced portfolio of 10-15 or more stocks, and potentially multiple portfolios can become a significant impost.

Consider your own situation – if you like to be hands on and are happy to commit the time needed to do justice to your investments, DIY may suit.

If, however, your work, family or other commitments don’t leave enough scope for adequate research and portfolio management, a managed fund may be an attractive option.

The Atlantic Pacific Australian Equity Fund

If you’re looking for an equity investment to support your long-term financial objectives, but are concerned about share market volatility, the APAEF may be an attractive option for you.

The APAEF is a long/short managed fund which typically buys or short sells Australian listed securities and S&P/ASX 200 futures contracts, with a core focus of capturing upside volatility while providing downside risk management. Rather than just chasing upside returns and selling down to cash as a defensive position (long) the Fund pursues active hedging strategies to help protect capital and also capture returns when the market goes down (short).

This proactive approach to risk management has delivered stable long-term returns, and has also smoothed out volatility during market downturns, as you can see below.

Visual representation of the APAEF’s downside capture vs the S&P/ASX 200 since inception in June 2013. Source: Australian Fund Monitors Product Assessment – Atlantic Pacific Australian Equity Fund, January 2023.

As at January 31, 2023, annualised returns since inception in June 2013 of the Fund are 9.3% p.a.* after all fees have been deducted, vs the S&P/ASX 200 Accumulation Index returning 8.9% p.a.

Importantly, due to our core focus on downside protection, the largest drawdown the Fund has experienced since inception in June 2013 was -7.7% while the largest drawdown for the S&P/ASX 200 in the same time period was -26.7%.^

For investors who are risk-averse and need decent returns to fund their lifestyle into retirement, the APAEF may offer an attractive solution especially in current market conditions.

Simply complete your details below and we’ll email you the latest fund information or promptly answer any questions you have:

[hubspot type=form portal=6426786 id=8ecbc087-b623-4299-a5e9-911260cae8a4]

References:

1) ASX Australian Investor Study 2020: https://www2.asx.com.au/blog/australian-investor-study

2) ABS, Managed Funds, Australia: https://www.abs.gov.au/statistics/economy/finance/managed-funds-australia/latest-release

3) Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry: https://www.royalcommission.gov.au/royal-commission-misconduct-banking-superannuation-and-financial-services-industry

Important information:

* Fund Returns are prepared on a redemption unit price basis after management and performance fees inclusive of GST. Distributions are assumed to be re-invested at the mid unit price. Individual tax is not taken into account in deriving Fund Returns. In calculating the NTA, the Atlantic Pacific Australian Equity Fund (“Fund”) asset values have been calculated using unaudited price and income estimates for the month being reported. Past Performance is not a reliable indicator of future performance. ASPEC Funds Management does not warrant that future forecasts are guaranteed to occur.

^Source: APSEC Funds Management, January 31, 2023: https://www.apsec.com.au/wp-content/uploads/2023/Fund-Performance-Reports/APAEF_202301.pdf