Until December 24, current clients of any Amalgamated Australian Investment Group (AAIG) business are eligible to invest in the Atlantic Pacific Australian Equity Fund (APAEF) at a discount rate of up to 50 basis points.**

In August 2020, the APAEF was awarded a coveted 5 Crown Fund Rating by FE fundinfo, parent company of Money Management, placing the APAEF in the top 10% of its assessed benchmark of more than 500 comparable Australian managed funds.

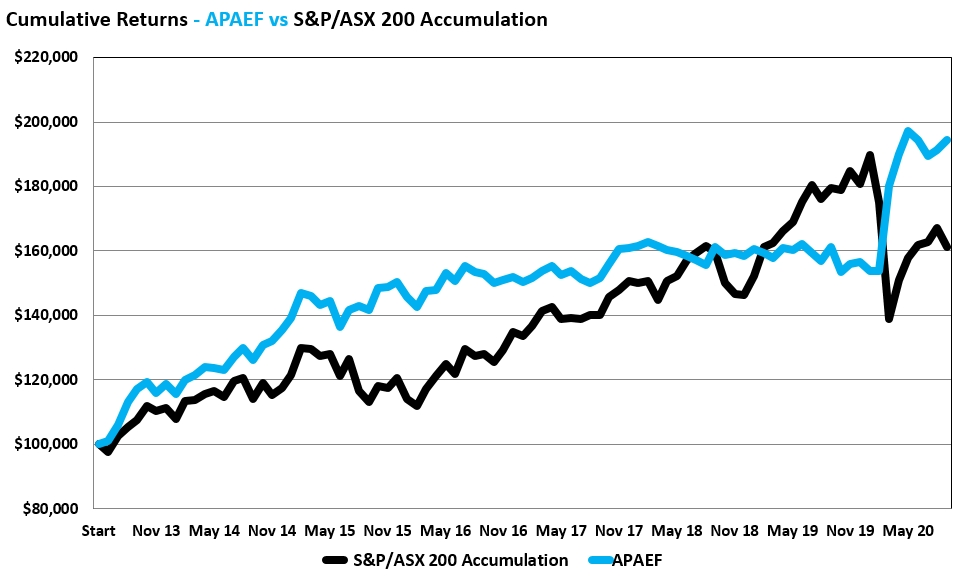

Moreover, FE fundinfo assess the APAEF as delivering these returns with lower volatility than the ASX200*, due to the Fund’s core focus on risk management.

Risk management is an essential part of our DNA. We are not prepared to accept large drawdowns in the funds entrusted to us by our investors, which is the reality faced by all long-only fund managers when markets move against them.

These active hedging and trading strategies helped protect and grow investor capital during the COVID-19 led market crash, and have powered the Fund’s long-term market outperformance.

Reasons to Invest

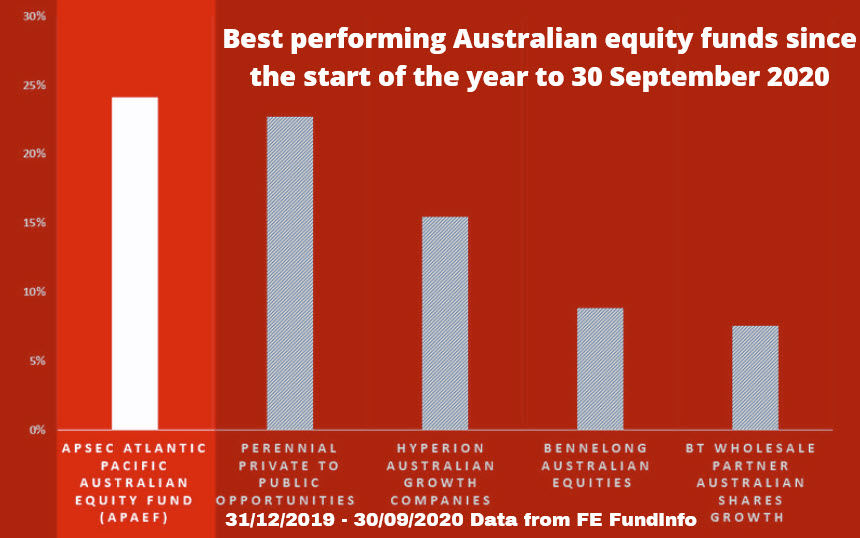

Money Management in October reviewed the performance of the Australian equity sector, which has continued to deliver negative returns throughout 2020, due to the ongoing economic fallout from the global pandemic.

The best performing fund in the sector was the Atlantic Pacific Australian Equity Fund (APAEF), returning 24.1%** since the start of the year to 30 September 2020, continuing the strong outperformance first identified by Money Management in its May feature and then again in July. Read more here.

The APAEF’s risk management and proactive trading mantra has allowed the Fund to significantly outperform the market since inception, and also smooth out volatility during market downturns.

* Annualised returns since inception in June 2013 of the Fund are 9.3% p.a.*** vs the S&P/ASX200 Accumulation Index returning 8.1% p.a. as at September 30, 2020. One Year return is 25.5% p.a.*** as at November 30, 2020.

Investor testimonial

“I started with APSEC last year.

I also entered the share market at the same time. APSEC capital is up $60,000 & my shares are down $40,000.

Thanks to Habib, Felix and the APSEC Fund Managers for doing such a great job in protecting and growing my capital during these times.

This is exactly the sort of investment I was looking for.”

Jenny Poett, October 2020.

Meet The Team

Nicolas Bryon

Fund Manager

Nicolas has been managing multi-billion dollar portfolios for global financial institutions and numerous hedge funds for over 20 years and helped preserve and grow capital through the GFC, several crashes, corrections and recessions.

George Paxton

George Paxton

Fund Manager

George is an experienced fund manager and financial analyst with an extensive portfolio of financial services skills. Previous experience includes senior positions providing banks and hedge funds with actionable intelligence and analysis.

Habib Chebli

Habib Chebli

Client Relationship Manager

Habib joined APSEC Funds Management in June 2019 to act as a client liaison and develop and grow Funds Under Management (FUM) through assisting Direct Investors, SMSF Trustees and Independent Financial advisers.

For investors who are risk-averse and need decent returns to fund their lifestyle into retirement, the Fund offers an attractive solution especially in current market conditions.

As a limited time incentive for new investors to join, until December 24, we are offering AAIG clients, including HALO, Macrovue, ASR Wealth Advisers and the Australian Stock Report the following special discount rebate:

- Invest $100,000 or more and receive a 50 basis point discount on the management fee^, or

- Invest under $100,000 and receive a 25 basis point discount on the management fee^.

(Minimum Investment in the Fund is $10,000).

Simply complete your details and a member of our team will contact you to get started:

[hubspot type=form portal=6426786 id=bf96d0ce-6bbb-4b07-aa65-4dc5dc84b004]

Online Application

If you’re ready to invest now, APSEC Funds Management has adopted OLIVIA, a secure, cloud-based online application process to make it easier for you to invest in our fund as an alternative to paper-based applications. To provide appropriate security for your personal information you will be required to provide your name, email address, and mobile phone number which will be used to protect your details. OLIVIA will also enable your identity to be verified online in real-time provided you have documents such as a driver’s license or passport and are on the electoral roll.

Important Fund Information

*Source: FE fundinfo, December 8, 2020 https://investmentcentre.moneymanagement.com.au/factsheets/mi/k1fx/apsec-atlantic-pacific-australian-equity

*Source:Money Management, 27 October 2020 https://investmentcentre.moneymanagement.com.au/news/5053330/which-aus-equities-led-the-way-after-nine-months

***Fund Returns are prepared on a redemption unit price basis after management and performance fees inclusive of GST. Distributions are assumed to be re-invested at the mid unit price. Individual tax is not taken into account in deriving Fund Returns. In calculating the NTA, the Atlantic Pacific Australian Equity Fund (“Fund”) asset values have been calculated using unaudited price and income estimates for the month being reported. Past performance is not indicative of future performance.

^The Fund has a management fee of 2% p.a, which is calculated on a monthly basis within the unit price. This an exclusive offer for new investors into the Fund who are existing AAIG clients, who will receive the basis point discount in the management fee in the form of rebated units each month. See the Fund PDS for full information on our standard fees. Please mention this special offer to our team, so we can ensure the discounted management fee is applied to your application.