How this fundie made 17pc in March

Originally published in the AFR Apr 27, 2020 by Robert Guy

Originally published in the AFR Apr 27, 2020 by Robert Guy

Nicolas Bryon has an unorthodox belief: he actually believes in market timing.

A willingness to rebuff the accepted market wisdom warning about the perils of doing so allowed the fund manager to outshine the “time in the market” crowd with a 17.2 per cent return in March.

Having navigated the volatility that torpedoed the track records of many of the market’s most feted hedge funds, the portfolio manager of the Atlantic Pacific Australian Equity Fund warns there may be more downside as investors confront the “sticker shock” of high unemployment and the fallout on consumer spending.

Bryon’s wariness is founded on his experiences travelling through Asia after the region’s financial crisis of the late 1990s, a massive shock that not only felled a number of economies but triggered a reshaping of societal views on spending and the use of debt.

“Once the Asian economies went through the Asian crisis their whole perspective changed. They weren’t willing to take on leverage, they weren’t willing to spend willy-nilly. A level of frugalness came back into the populace.”

He sees the prospect of a similar dynamic playing out in the wake of the COVID-19 crisis, which has produced massive job losses as social distancing restrictions have come into force and economies have been placed into hibernation mode.

“When you have people blindsided by COVID-19, not necessarily getting another job for another year, the psyche of those individuals will change,” he says.

“It’s going to be 10 to 15 per cent of the population who thinks that way. There will be the haves and have-nots, not that it’s any different to what we had before, but I think the have-nots are going to have major issues with propensity to spend.”

Bryon, whose fund has around $30 million in funds under management, says he had been expecting a sell-off for about a year given the more than decade-long bull run and the extended valuations of many popular, and richly valued, stocks.

He adds the reporting season in February didn’t provide the positive earnings trajectory needed to justify valuations.

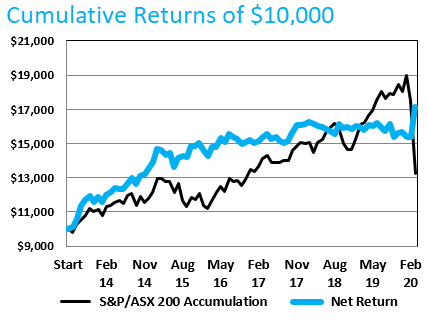

The fund typically has a long bias – but is very rarely at 100 per cent net exposure – but is focused on downside risk management and capital preservation.

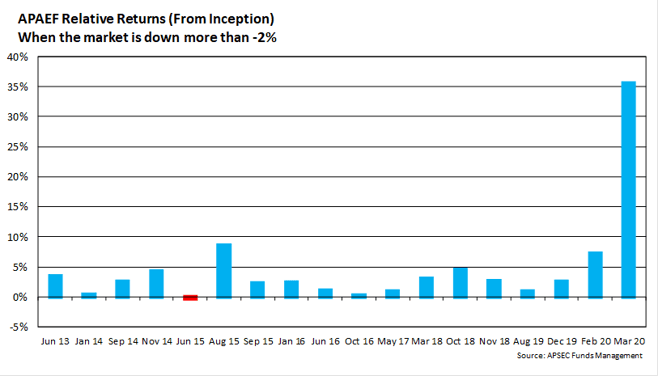

The fund, established in 2013, has a track record of outperforming when the market declines more than 2 per cent.

Bryon’s belief in market timing is based on the exposure of stocks to large declines and his desire to avoid “sequencing risk”, or the need for investors to access their funds as they retire.

“If you look at the peak of the GFC and the recent peak, the annualised return was about 5 per cent,” he says. “But in the meantime you’ve drawn down half your capital and it’s taken you 12 years to get 5 per cent annualised returns.

“To me, given that equities are a high-risk investment vehicle, if I can take those drawdowns out then I will.

“That’s why I have a bias to saying if you can time the market then fantastic.”

Predicting risk not events

He also disagrees with the idea that big sell-offs like that seen in March are Black Swan events, or events that cannot be forecast.

“I just don’t agree with that concept because these things happen quite regularly. You can’t predict it, it’s nothing you can predict, but they happen all the time.”

“If your mentality is that you know these things are going to happen and you have the tools to protect capital when these things do happen, then why wouldn’t you use those tools? That’s what we do.”

That tool is an analytical system he calls HALO, which feeds into what he calls the quadruple alpha process. That’s a combination of fundamental stock analysis, event analysis, an understanding of macroeconomic issues, and quantitative analysis.

“It’s also experience of looking at markets, how to interpret economics, knowing when markets are risky,” Bryon says.

The combination of analysis and experience paid off in March.

Read the original article here: https://www.afr.com/markets/equity-markets/how-this-fundie-made-17pc-in-march-2020