Money Management this month featured the Atlantic Pacific Australian Equity Fund (APAEF) as one of only 2 Australian Equity funds that made money in March, outperforming a bear hedge fund specifically geared to profit from market downturns. The article states:

“According to FE Analytics, APSEC’s Atlantic Pacific Australian Equity fund returned 17.19% in March, while the BetaShares Australian Equities Bear Hedge fund returned 16.85%, and the average sector return was a loss, within the Australian Core Strategies universe, of 19.46%.”

The APAEF, which is celebrating it’s 7-year Anniversary milestone in June, is a long-bias equity market product which typically buys or short sells Australian listed securities and derivatives. As fund manager Nicolas Bryon explained, managing downside risk is what we do well.

“We don’t necessarily believe you can do that consistently with stocks per se… [but] when we go through events like this, we put on more shorts related to the thematic or lower the beta of the actual longs as well,” Bryon said.

The Fund started taking off all market risk off in February, over several weekends before the March sell-off. This fully hedged portfolio was a key to the fund’s success during the March maelstrom that drove the S&P/ASX 200 Index down 21.2 per cent – that was long stocks, short stocks and short share price index (SPI) futures – hedging out all risk over the weekends.

Risk management is an essential part of our DNA. We are not prepared to accept large drawdowns in the funds entrusted to us by our investors, which is the reality faced by all long-only fund managers when markets move against them.

The APAEF was created as a long/short fund that can capture upside volatility while minimising downside volatility, a philosophy we believe will allow us to continue to outperform over the long term.

Rather than just chasing upside returns and selling down to cash as our defensive position (long), we pursue active hedging strategies to protect capital and also capture returns when the market goes down (short).

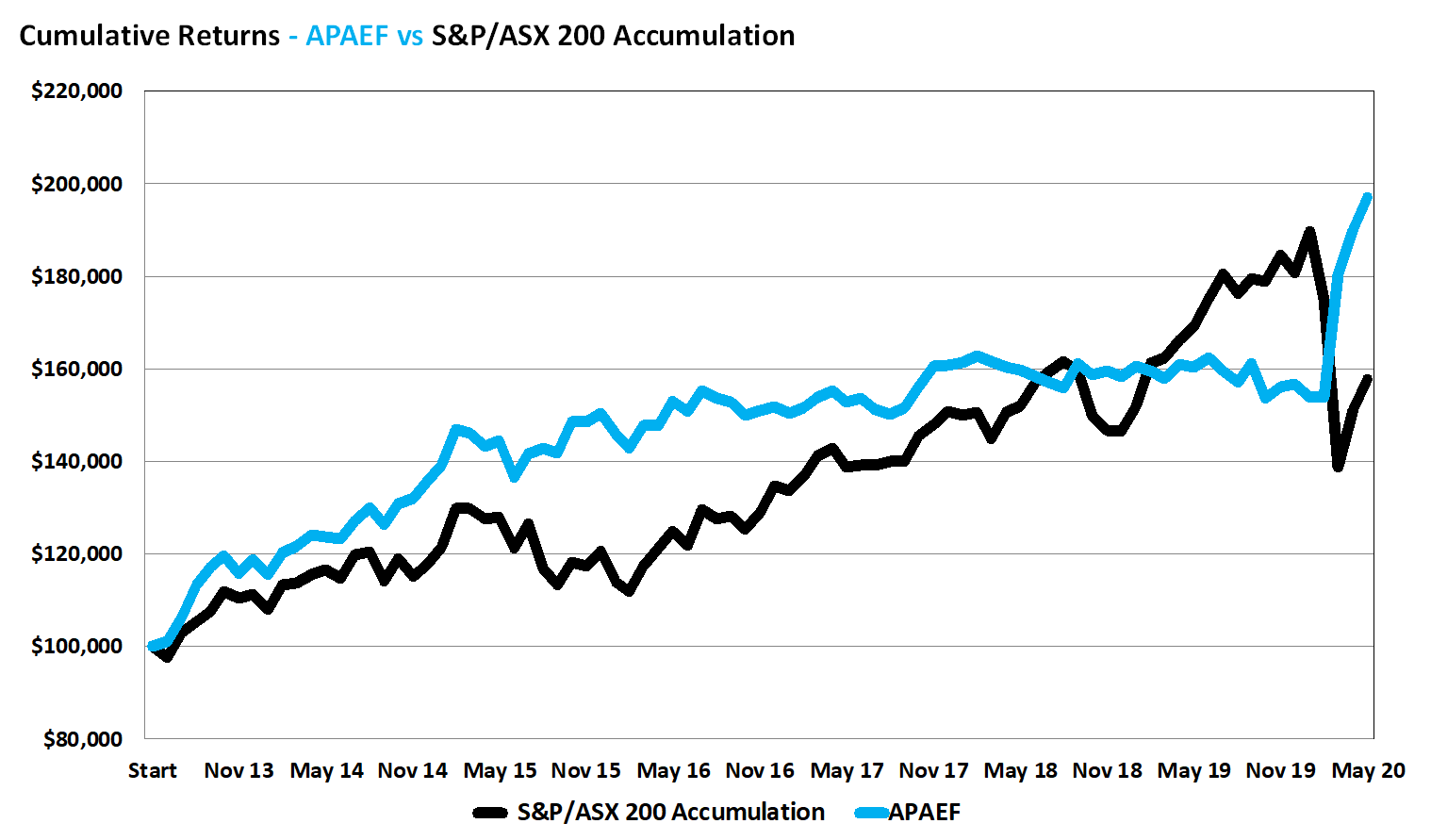

This risk management and proactive trading mantra has allowed the Fund to significantly outperform the market since inception, and also smooth out volatility during market downturns, as you can see below.

Cumulative Returns of $100,000 since June 2013

* Source APSEC June 5, 2020. Cumulative returns since inception in June 2013 of the Fund are 10.1% p.a. vs the S&P/ASX200 Accumulation Index returning 6.6% p.a. as at May 31, 2020.

This is especially important for many investors and retirees right now, helping address the dilemma of moving into cash and getting almost zero real returns or moving into shares and facing the ongoing risk of significant capital loss in the event of another market correction or crash.

For investors who are risk-averse and need decent returns to fund their lifestyle into retirement, the Fund offers an attractive solution especially in current market conditions.

To learn more about the APAEF, simply complete your details below and we’ll email you the latest fund information.

[hubspot type=form portal=6426786 id=25d7147c-395b-4fb7-af4c-329d97ff61ce]