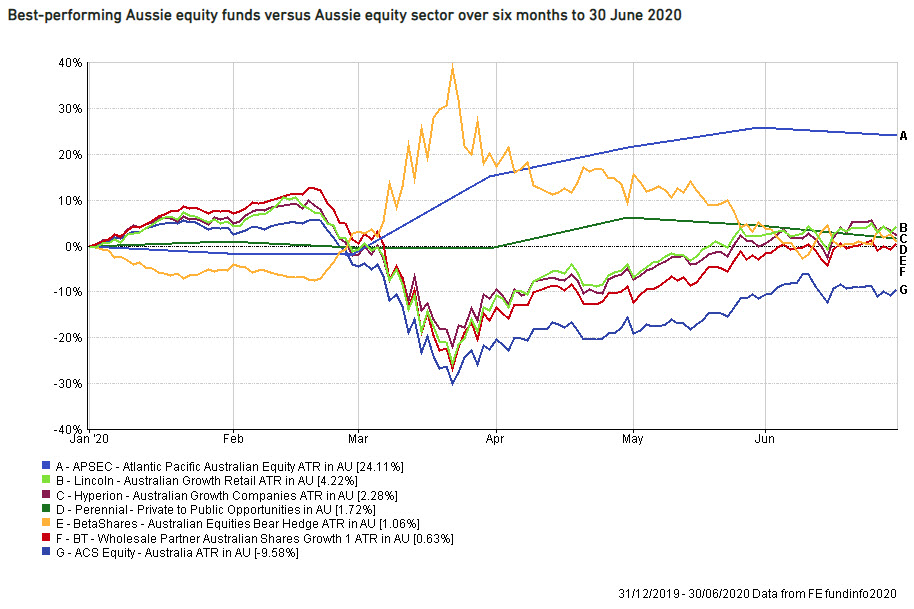

Money Management in July reviewed the performance of the Australian equity sector, which lost 9.5% during the first half of the year due to the COVID-19 pandemic. According to FE Analytics, within the Australian Core Strategies universe, of the 227 funds in the sector only six managed to post a positive return in the 6 months to June 2020.

Of these, the best performing fund was the Atlantic Pacific Australian Equity Fund (APAEF) returning 24% during this period, continuing the strong outperformance identified by Money Management in its May feature.

The APAEF, which celebrated it’s 7-year Anniversary milestone in June, is a long-bias equity market product which typically buys or short sells Australian listed securities and derivatives, with a core focus on downside protection.

Risk management is an essential part of our DNA. We are not prepared to accept large drawdowns in the funds entrusted to us by our investors, which is the reality faced by all long-only fund managers when markets move against them.

Rather than just chasing upside returns and selling down to cash as our defensive position (long), we pursue active hedging strategies to protect capital and also capture returns when the market goes down (short). This is achieved through a combination of long stocks, short stocks and short share price index (SPI) futures to hedge out risk.

These are the strategies that allowed the Fund to make 17.19% while the market crashed in March, and continue to generate positive returns as share prices recover.

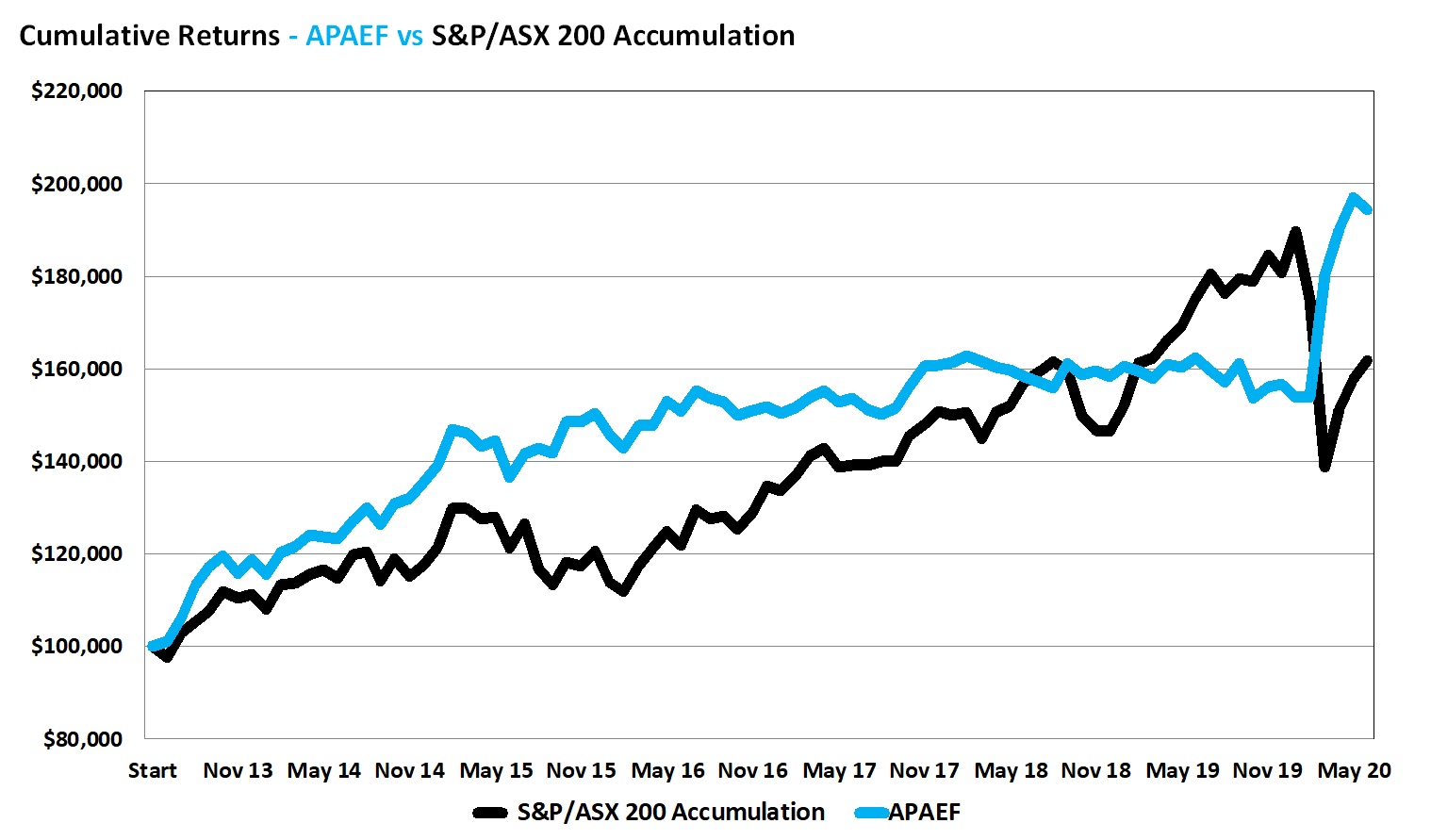

This risk management and proactive trading mantra has allowed the Fund to significantly outperform the market since inception, and also smooth out volatility during market downturns, as you can see below.

* Annualised returns since inception in June 2013 of the Fund are 9.7% p.a. vs the S&P/ASX200 Accumulation Index returning 6.9% p.a. as at June, 2020.

This is especially important for many investors and retirees right now, helping address the dilemma of moving into cash and getting almost zero real returns or moving into shares and facing the ongoing risk of significant capital loss in the event of another market correction or crash.

For investors who are risk-averse and need decent returns to fund their lifestyle into retirement, the Fund offers an attractive solution especially in current market conditions.

Simply complete your details below and we’ll email you the latest fund information:

[hubspot type=form portal=6426786 id=c09c7f08-4264-4ee3-af28-e9f1ca2ed13a]