The trillions of dollars of stimulus propping up economies and asset markets since the March 2020 COVID-19 crash have now, inevitably, led to overheating global economies leading to surging inflation which central banks globally are struggling to rein in. In addition, further passthrough of inflation due to surging energy prices brought about by the Ukraine Invasion is extending the inflation cycle.

Nicolas Bryon, the Fund Manager of the Atlantic Pacific Australian Equity Fund (APAEF), has been warning since late 2021, of the impending rise in interest rates and the “reactionary tales” of central banks that would follow.

Despite several recent interest rate rises, and indications in April that price growth was stabilising, last Friday’s US headline May inflation rate of 8.6 per cent, the highest increase since December 1981, has highlighted the severity of the current situation. This led to a larger than expected rise in the US Federal Funds rate of 75bps versus expectations of 50bps. Is this the US Fed trying to tame inflation or is it a deliberate attempt to slow an already overheating global economy? It remains to be seen what is the eventual outcome over the coming year.

This has triggered further steep share price falls over the past week, with the major US markets now officially in bear territory – a fall of 20 per cent or more. As at June 14, the S&P 500 has fallen 23 per cent from its peak in early January to its recent low, and the NASDAQ index is now down 33 per cent from its record highs in November 2022.

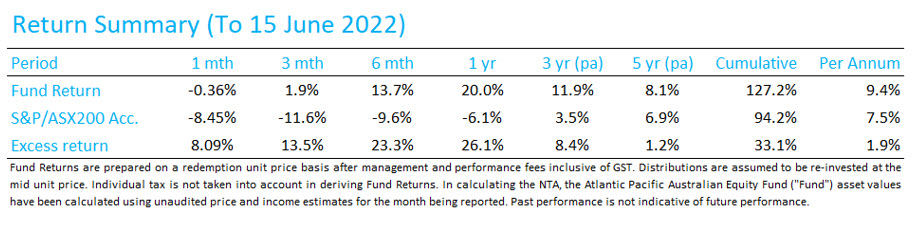

Australian markets buffeted by resources and with a lower concentration of tech stocks have fared slightly better, but are still substantially down across the past 12 months, as shown below.

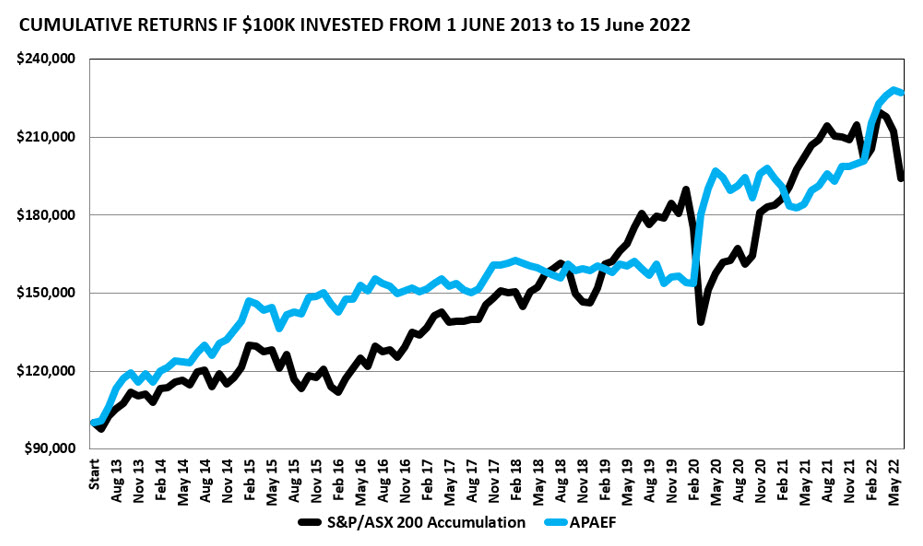

Throughout this challenging period, the Atlantic Pacific Australian Equity Fund (APAEF) has again proven the value of our core focus on risk management, which we believe is key to long-term wealth generation. And as history has shown, this strategy has worked over the long run, to date.

We’ve always been deeply concerned about the potential consequences of sequencing risk, especially for investors in, or nearing retirement. After all, it always takes more than the initial loss to recover from a drawdown in your holdings – a 20% drop would need 25% growth, while a 50% drop would need 100% gain just to break even!

Pleasingly, the largest drawdown (drop in portfolio value) the Fund has experienced in 9 years since inception in June 2013 is only -7.7%, while the largest drawdown for the S&P/ASX 200 in the same time period was -26.7%.^

We’ve achieved this partly through our use of hedging instruments to minimise downside volatility, but also through a conscious strategy of avoiding speculating in stocks where the underlying valuations don’t stack up, as was common in recent years.

Strong stable investment returns

This has also allowed the Fund to outperform the market since inception, and substantially smooth out volatility during market downturns, as shown below.

Source: APSEC Funds Management, June 15, 2022. Annualised returns since inception in June 2013 of the Fund are 9.4% p.a. vs the S&P/ASX 200 Accumulation Index returning 7.5% p.a. as at June 15, 2022. If an investor invested $100,000 into the APAEF in June 2013 and reinvested all distributions, their initial investment would now be worth $227,200, after all fees have been deducted. Individual tax has not been taken into account.*

* Fund Returns are prepared on a redemption unit price basis after management and performance fees inclusive of GST. Distributions are assumed to be re-invested at the mid unit price. Individual tax is not taken into account in deriving Fund Returns. In calculating the NTA, the Atlantic Pacific Australian Equity Fund (“Fund”) asset values have been calculated using unaudited price and income estimates for the month being reported. Past performance is not a reliable indicator of future performance. APSEC Funds Management does not warrant that future forecasts are guaranteed to occur.

If you’re looking for appreciable long-term investment returns to support the future you deserve, but are concerned about and want help navigating share market risk, the APAEF may be a good choice for you.

Get in touch today and we’ll send you all the information you need to help decide how the APAEF’s long/short investment approach could help diversify and add protection to your own and your clients’ investment portfolio.

[hubspot type=form portal=6426786 id=3a54f3e4-aa5a-4a9f-b596-39bf74e24b4b]

All information correct as at June 15, 2022.

* Fund Returns are prepared on a redemption unit price basis after management and performance fees inclusive of GST. Distributions are assumed to be re-invested at the mid unit price. Individual tax is not taken into account in deriving Fund Returns. In calculating the NTA, the Atlantic Pacific Australian Equity Fund (“Fund”) asset values have been calculated using unaudited price and income estimates for the month being reported. Past performance is not a reliable indicator of future performance. APSEC Funds Management does not warrant that future forecasts are guaranteed to occur.

^ APSEC Funds Management, June 15, 2022: https://www.apsec.com.au/wp-content/uploads/historic/APAEF-Returns-to-20220615.pdf